Thanks for stopping by to read our article on CME Bitcoin Futures.

The world's largest futures exchange, CME, announces it has completed self-certification with the Commodity Futures Trading Commission to introduce CME bitcoin futures contract on Dec. 18.

Read the full article below.

CME Bitcoin Futures

CME announced Friday its brand-new CME bitcoin futures agreement will be available for trading on Dec. 18.

The CME announcement came as the Commodity Futures Trading Commission said it will allow the world's largest futures exchange and its competitor, the Cboe Futures Exchange, to release bitcoin agreements and trade CME Bitcoin Futures. Cantor Exchange also self-certified a brand-new contract for bitcoin binary options, the commission stated.

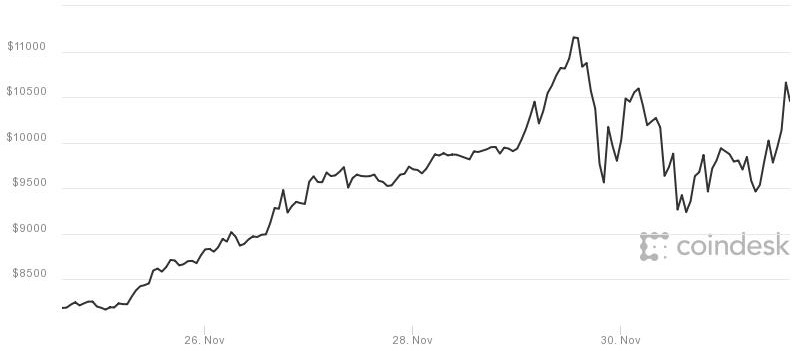

Bitcoin traded more than 6 percent greater at $10,539 on Friday, recovering partially from a 20 percent drop to $9,021.85 from a record high of $11,377.33 hit Wednesday, according to CoinDesk.

“I think it is going to make it possible for the approval of bitcoin ETFs, and other digital currency ETFs, which is game changing,” Barry Silbert, founder and CEO of Digital Currency Group, said on CNBC's “Squawk Box.”

Bitcoin this week – CME Bitcoin Futures Effect

CME's announcement comes as other significant exchanges hurry to release their own bitcoin derivatives products and to trade CME Bitcoin Futures.

Shares of CME surged 1.7 percent to an all-time high Friday early morning. Cboe's stock traded little bit lower after setting a record close Thursday.

The CFTC does not authorize derivatives agreements or endorse their underlying properties.

“Commission personnel held extensive conversations with CME during six weeks, CFE throughout 4 months, and had many calls with Cantor.” a CFTC release said.

“Bitcoin, a virtual currency, is a commodity unlike any the Commission has dealt with in the past,” CFTC Chairman J. Christopher Giancarlo said in a declaration. “As a result, we have had extensive conversations with the exchanges concerning the proposed agreements, and CME, CFE and Cantor have consented to significant improvements to protect consumers and keep organized markets.”

In a different release Friday, Cboe stated it has actually filed a product certification with the Commodity Futures Trading Commission to offer CME bitcoin futures trading and trade CME Bitcoin Futures. The certification undergoes regulatory review and a launch date “will be revealed soon,” according to a release.

A Cboe representative at first told CNBC the CME bitcoin futures launch is expected “most likely before completion of the year,” but later on clarified, saying the exchange could not be that specific about trading CME Bitcoin Futures. “We are operationally ready and we will be revealing a launch date quickly,” the representative stated.

Nasdaq plans to release CME bitcoin futures as early as the 2nd quarter of 2018, exchange authorities informed CNBC on Thursday. Nasdaq would base its price off of 50 bitcoin sources from worldwide, while Cboe is currently using one and the CME is using 4, a Nasdaq representative said.

Nasdaq shares traded mildly greater after closing at a record Thursday.

Follow Us on Social Media Below (We are a Real People :)):

Subscribe To Our YouTube Channel Here

Thanks,

Leave a Reply